At the beginning of the New Year, the domestic sulfur spot market failed to show a good start, and the sentiment of most merchants to wait for the market still continued at the end of last year. At present, it is not possible to give more directional information in the outer disk, and the late performance of domestic terminal capacity utilization is unknown, and the subsequent arrival volume of port is expected to be more, so that merchants have more concerns about market operation. Especially in the context of port inventory being at a relatively high level for a long time and unable to be completely improved for a period of time, the suppressed market mentality has caused operators to be afraid of operating on the field and differences of opinion are temporarily difficult to eliminate. As for when the pressure on Hong Kong stocks will be eased, we still need to wait for an opportunity to emerge.

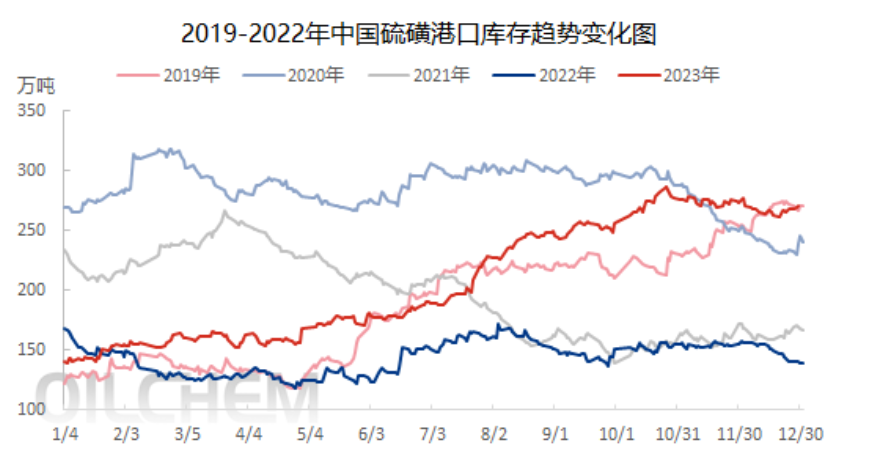

It is not difficult to see from the figure above that China’s sulfur port inventory data in 2023 shows a significant upward trend. The 2.708 million tons on the last working day, although only 0.1% more than the year-end port inventory in 2019, has become the highest point in the year-end port inventory data in the past five years. In addition, Longzhong Information data show that in the comparison of port inventory data at the beginning and end of the past five years, the increase in 2023 is second only to that in 2019, which is 93.15%. In addition to the special year 2022, it is not difficult to find that the comparison of inventory data at the beginning and end of the remaining four years has a great correlation with the market price trend of the year.

In 2023, the average national port inventory is about 2.08 million tons, an increase of 43.45%. The main reasons for the increase in China’s sulfur port inventory in 2023 are as follows: First, with the overall performance of the demand side significantly better than last year, the purchase interest of both downstream factories and traders for imported resources has been significantly mobilized (China’s sulfur import data from January to November 2023 has exceeded the total amount of last year is verified). Second, the market price is significantly lower than last year’s level, and some holders have covered positions to balance costs. Third, under the background of the first two points, the domestic continued incremental performance, the operational flexibility of the terminal in the purchase of resources has increased, and the repatriation of resources on the port has been less than before in some periods.

Overall, for most of 2023, sulfur port inventories and prices showed a more reasonable negative correlation. From January to June, due to the poor performance of the demand side, the capacity utilization rate of the industry has been running at a relatively low level, coupled with the increase of domestic production, resulting in the slow consumption of resources stored in the port. In addition, both traders and terminals have corresponding imported resources into Hong Kong, which promotes the continuous rise of Hong Kong stocks. From mid-late September to December, the long-term accumulation of port inventories has reached a three-year high, while the capacity utilization rate of the main downstream phosphate fertilizer industry has entered a downward trend, and the spot market has shown a weak trend under the pressure of the industry’s mentality, while from July to mid-early September, port stocks and prices have shown a positive correlation, the reason is that the domestic phosphate fertilizer industry has gradually recovered at this time. Capacity utilization is rising to relatively high levels. In addition, the relatively low price prompted traders to catch speculative sentiment ignited, and the relevant inquiry buying operation was immediately launched. At this time, the resources only completed the transfer of goods in the port, and did not flow to the terminal factory depot. In addition, due to the increase in the difficulty of spot inquiry, which causes merchants to chase US dollar resources, Hong Kong stocks and prices have risen simultaneously.

At present, it is known that Zhanjiang Port and Beihai Port in the southern Port area have resource ships that are unloading operations, of which Zhanjiang Port has two ships with a total of about 115,000 tons of solid resources, and Beihai Port has about 36,000 tons of solid resources, in addition, there is a high probability that Fangcheng Port and the above two ports will still have resources to the port. However, incomplete statistics on the subsequent resource arrival of ports in the Yangtze River region have exceeded 300,000 tons (Note: affected by weather and other factors, the shipping schedule may be subject to certain variables, so the actual arrival volume of the port is subject to the terminal). Combined with the unknown of the terminal mentioned above, it is conceivable that the resistance to the establishment of market confidence will be given. But is the so-called mountains and rivers doubt no road, willow flowers bright and a village, there will always be unknown and variables in the operation of the market, who can confirm that there will not be Qingshan like cocoon wrapped people, do not believe that there is a road ahead of the scene.

Post time: Jan-08-2024